BLUF

Strong revenue growth does not guarantee financial stability. Businesses that lack cash flow visibility, disciplined forecasting, and alignment between spending and collections often struggle despite healthy top-line performance. Clear cash flow management enables proactive decision-making, reduces financial stress, and supports sustainable growth.

Revenue growth is often celebrated as the clearest signal of business success. New customers, larger contracts, and rising topline numbers create confidence that an organization is financially healthy and moving in the right direction.

Yet many growing businesses experience persistent cash flow pressure even as revenue continues to climb.

This disconnect is not unusual. In fact, it is one of the most common challenges faced by scaling organizations. Understanding why it happens is the first step toward building lasting financial stability.

Revenue Does Not Equal Usable Cash

One of the most misunderstood aspects of financial management is the difference between revenue and cash.

Revenue represents sales that have been earned. Cash represents money that has actually been collected. A business can show strong monthly or quarterly revenue and still struggle to make payroll, pay vendors, or invest in growth.

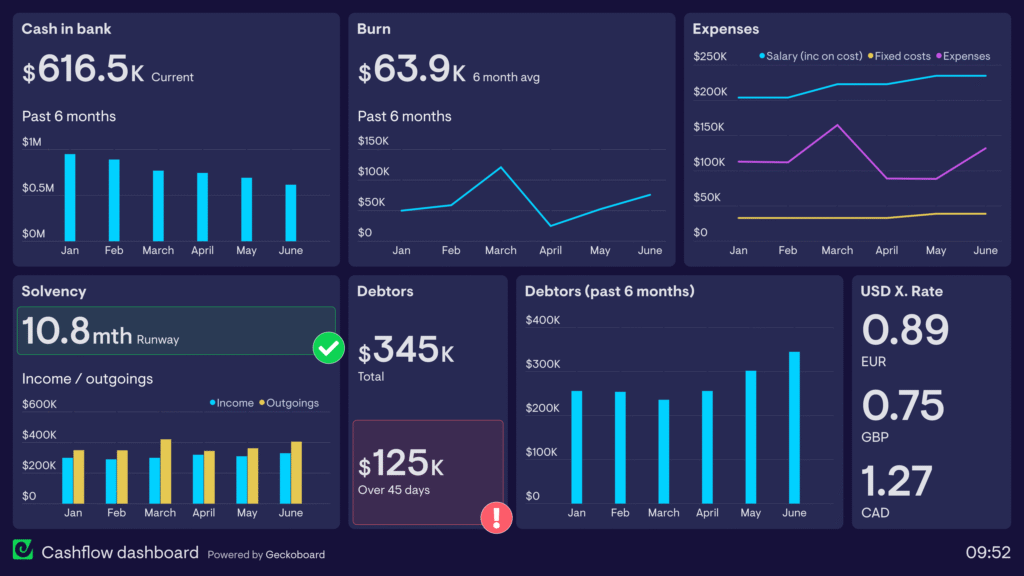

This often occurs when cash inflows lag behind expenses. Delayed customer payments, long billing cycles, retainers billed in arrears, or milestone-based contracts can all create timing gaps between when revenue is recorded and when cash is received.

As revenue grows, these gaps often widen rather than disappear. Without a clear view of when cash enters the business, leaders may make decisions that look sound on paper but place real strain on liquidity.

Timing Mismatches Quietly Undermine Cash Flow

As organizations scale, expenses tend to move faster than collections. Hiring, vendor commitments, technology investments, and infrastructure costs are often incurred upfront, while revenue is realized over time.

When spending decisions are made based on revenue expectations rather than cash availability, businesses can fall into a cycle of reacting to short-term cash needs. This reactive posture limits flexibility and increases stress at the leadership level.

Cost Structure Creep Often Goes Unnoticed

Growth introduces complexity. New hires, upgraded tools, and additional services are layered in over time. Individually, these decisions may seem reasonable. Collectively, they can materially change the organization’s cash profile.

Without regular review and financial discipline, expenses can outpace the business’s ability to convert revenue into usable cash.

Lack of Forecasting Forces Reactive Decisions

Many organizations operate with a backward-looking view of their finances. Historical reporting explains what happened, but it does not answer the questions leaders need to plan forward.

How much cash will be available in the next 30, 60, or 90 days

What commitments are already locked in

Which decisions introduce risk and which are sustainable

Without reliable forecasting, leaders are forced to react instead of plan.

Practical Steps to Create Cash Flow Clarity

Cash flow stability does not require complexity. It requires discipline.

A forward-looking cash flow forecast based on actual collection timing should guide decisions. Spending should be aligned to cash availability, not just revenue expectations. A consistent financial operating rhythm keeps leaders informed and proactive.

Clarity Changes How Businesses Operate

When leaders understand the difference between revenue and usable cash, decision-making improves. Conversations shift from urgency to intention. Growth becomes sustainable because it is supported by visibility rather than optimism.

This is where experienced financial leadership adds value. Not by producing more reports, but by helping organizations see clearly, plan realistically, and move forward with confidence.

If this resonates, the next step is simple. Assess whether you truly have forward-looking visibility into your cash position. If not, a short conversation can help identify where clarity is missing and what changes will have the greatest impact.

At FinTech Innovations, the focus is on helping growing businesses gain that clarity so financial performance supports strategy rather than constrains it.